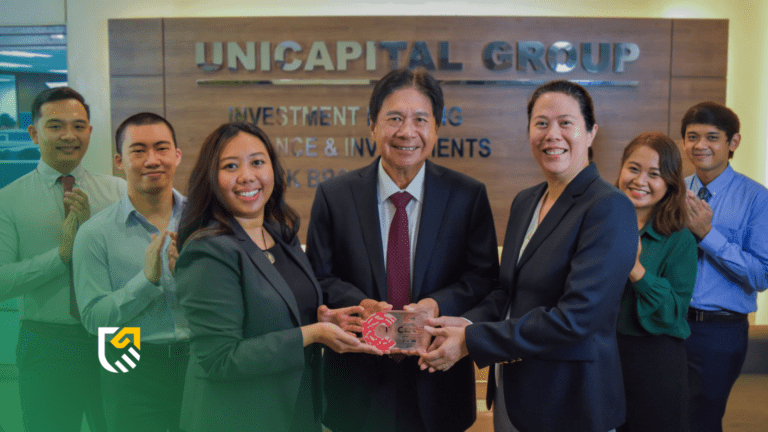

Unicapital, Inc., a leading independent, full-service investment house, has won the 2022 “Innovative Deal of the Year” award from Singapore-based business magazine Asian Banking & Finance (ABF) for the successful P6.4-billion initial public offering (IPO) this year of the country’s first-ever renewable energy-focused real estate investment trust (REIT).

Unicapital received the ABF award in recognition of the crucial role it played as financial advisor, issue manager and lead underwriter for the offering of Citicore Energy REIT Corporation (CREIT).

“This recognition from ABF highlights Unicapital’s strength and creativity in packaging financial solutions for clients even under challenging market conditions. Our full range of financial services, extensive experience, expertise and familiarity in handling customized financial solutions helped turn CREIT into an IPO success story,” Unicapital President and CEO Jaime Martirez said. “The support we gave CREIT typifies the kind of service we provide our clients,” Martirez added.

Nearly 20,000 investors swamped CREIT’s offering despite political and economic uncertainties hovering over the stock market during CREIT’s five-day offering period in early February this year.

Martirez said during the recent ABF online awarding ceremony that Unicapital showed innovation and creativity by positioning the CREIT deal “as a defensive ESG [environmental, social, and governance] stock investment, which we believed was well suited to the market conditions at the time.”

ABF holds the annual awarding ceremony to honor “The Best of the Best” financial institutions in Asia for their noteworthy performance in delivering exceptional services to their customers.

“The IPO allowed CREIT’s parent company to recycle invested capital in its 163-megawatt installed renewable energy projects [and to] raise P6.4 billion in fresh capital to partially fund its robust 1.5-gigawatt pipeline of renewable energy projects,” Martirez pointed out during the awarding ceremony.

Described as companies organized mainly for owning income-generating real estate assets, REITs are allowed by law to distribute at least 90 percent of their income to shareholders, making them attractive to investors who prefer an assured dividend income.

But before the CREIT offering, not a single power company – much less renewable energy firm — tried the nascent Philippine REIT market as an avenue in going public, Unicapital Senior Vice President Pamela Louise Victoriano explained during the ABF ceremony. This allowed the Philippine REIT market to be dominated by office-themed REITs.

In the regulations, however, REIT’s definition includes “other income-earning real estate assets” outside of office buildings. Victoriano said that Unicapital saw this as an opportunity to turn CREIT into the first renewable energy company to go public as a REIT.

Victoriano explained that Unicapital structured the CREIT offering in such a way that it helped support the government’s energy program to further develop much-needed power plant capacity, while meeting at the same time the capital market’s demand for investment products with a strong ESG appeal and an assured dividend income. CREIT subsequently debuted as a publicly listed company on the PSE last Feb. 22.

About Unicapital

Unicapital provides clients with an integrated and customized range of products and services designed to help its clients grow and achieve financial success. These products and services allow Unicapital Inc. and subsidiaries Unicapital Finance and Investments, Inc., and Unicapital Securities, Inc., to give its clients a wide array of financial solutions that include underwriting IPOs, financial advisory, loans and financing, as well as fund placements and securities trading for clients.

Unlike most investment houses, Unicapital has been thriving and operating for several decades now independent from universal and commercial banks. Unicapital shareholders supporting the company include GMA Network Inc., and firms controlled by former GMA Network president Menardo Jimenez, who is Unicapital’s Chairman Emeritus; and GMA Network’s current chairman Felipe Gozon; and Naito Securities Co. Ltd. of Japan.

Sources:

Business Mirror: Investment house Unicapital feted for ₧6.4-B IPO of PHL’s 1st RE-focused REIT

Manila Bulletin: Unicapital wins 2022 Asian Banking & Finance award

Manila Standard: Unicapital bags ‘innovative deal of the year’ award